Today’s Fear and Greed Index for Bitcoin and the Cryptocurrency Market is calculated daily using multi-factor sentiment analysis for the cryptocurrency market. Many traders use it in their day to day to apply their buying or selling decisions.

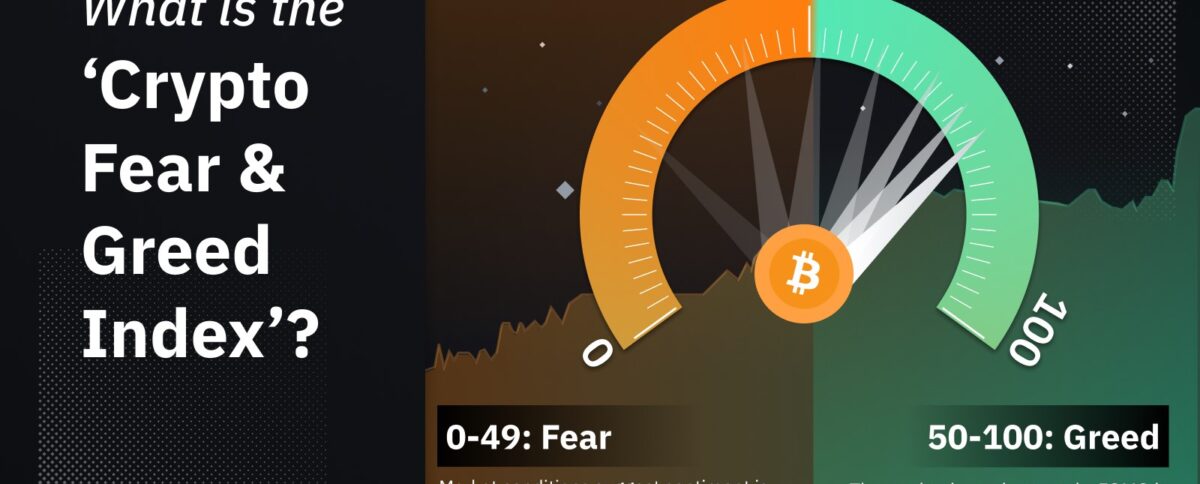

The range is from 0 (highest level of fear) to 100 (extreme greed) and is determined by various factors including Bitcoin’s dominance against altcoins, volume, volatility, social media, and financial market trend. in general.

This is the Fear and Greed Index for Today:

Why is this cryptocurrency market index important?

This index is essential as a tool to make an investment, since it is a very emotional and volatile market. As soon as there is a big rise or a big drop due to a news that generates FOMO or FUD and these emotions and volatility are reflected in this indicator to reflect the sentiment in real time.

If the market falls, fear appears and if the market rises, greed is generated. Following this scheme for investors, it is usually a good option to make purchases when there is extreme fear, on the other hand, when extreme greed appears, it usually coincides with a good time to sell cryptocurrencies. In this video they explain everything very well in case you want to take a look:

What is the source of this data?

The Crypto Fear and Greed index has been created by Alternative.me in which they have invested technology so that this index automatically calculates a value in real time based on the following patterns.

- Volatility (represents 25% of the total value calculation)

Market volatility is one of the most important values to take into account when investing and represents the number of market transactions at that time, whether they are purchases or sales, compared to a historical record. It cannot be determined by this value if it is a bullish or bearish signal, since in the bear market it will imply sales, but in the bull market it will imply purchases. What is certain is that the increase in volatility will be an indication of a price change. - Market Volume (represents 25% of the total value calculation)

The volume reflects the momentum of the market and the interest in buying or selling at a certain moment. For its calculation, the last 30/90 days are taken into account in order to have a sample space large enough to make a valid comparison and determine the real momentum of the market at that moment. The greater the volume of purchase, the greater the value of the indicator will also be, while if the volume is of sale, the value will be lower. - Social Networks (represents 15% of the total value calculation)

Nowadays, social networks and the posts published on them give us extremely valuable information to determine the human sentiment that exists in the market at this time. The main social network to look at is X/Twitter as often market positive or negative posts can provide an important indication of market sentiment. Market sentiment is largely gathered from Twitter as it is the social network commonly used by followers of the crypto world. - Bitcoin dominance (represents 10% of total value estimate)

Bitcoin is the most important cryptocurrency on the market. Its price usually marks the value of alt coins. If Bitcoin goes up or down, the rest follow. The Bitcoin domain represents the percentage of this currency over the total crypto market. And why is this information important? Very easy! In times of fear or uncertainty, investors tend to lean on Bitcoin since despite its high volatility it is the one that represents a safer value. On the other hand, when investors abandon Bitcoin to buy other alt coins, it is an indicator of security and a speculative mood, seeing the market optimistically. - Google Trends (represents 10% of the total value calculation) The Google trends tool is very useful to find out the most or least popular searches at a given time. A high volume of searches on Google (which is the most important search engine in the world) will indicate a high interest on the part of users in a certain concept. If we extract from these trends only the searches that refer to the crypto market, Voilà!

Surveys(15%) [currently on pause]

It has been decided to ignore this parameter when calculating the index. An American survey company was used to collect data from users interested in cryptocurrencies. Despite the fact that at an initial moment the tool was useful data to take into account, as the market has increased and they have been able to collect more precise and current information on the other factors, they have decided to stop using it, but they do not rule out use it again in the future.

Where does the Crypto Fear & Greed Index come from?

The initial idea behind this famous index is from the CNN Business, which created its own solely focused on the stock market years ago. The idea is essentially the same, adapting it to the cryptocurrency market in which the emotional component is much greater, so changes and modifications have been made based on this factor to make it as accurate as possible.

Can this index indicate the best time to invest in crypto?

The reality is that it is just one of many tools that can be used to decide when to enter or exit the market. Furthermore, it is an index that perfectly measures past behavior, but cannot predict the future. For this reason, we recommend that you take into account other tools and factors and in any case bear in mind that the information that we publish here is in no way financial or investment advice, but is only about trying to help our users with a added information when making your buying or selling decisions.