In the world of cryptocurrencies, there is a term that often puzzles newcomers and amuses veterans: HODL. Surely you have seen it written on social networks or in a forum. In this article, we will delve into this fascinating concept, what it means, where it came from, and why it has become a cornerstone of crypto culture.

What does the concept HODL mean?

HODL may be an acronym for «Hold On for Dear Life.» Yes, you read it right. This new word used by crypto-bros does not describe any elaborate financial strategy; rather it is a rallying cry of the crypto community.

When you “HODL” your crypto, you are essentially holding onto your digital assets, regardless of market volatility. It is a decision not to succumb to the emotional roller coaster of volatility characteristic of cryptocurrency investments. Whether the market is rising or crashing, a true HODLer stands still.

The origins of HODL

The HODL mentality

It’s simple but powerful: it’s all about riding the waves of volatility and not panicking when the market falls. Buy the dips and hold the buy for the long term. In addition, we explain why in our opinion it is a strategy that makes sense:

- Long-term vision: HODLers believe that cryptocurrencies are the future of finance. They are not concerned with short-term price fluctuations; they are looking years, even decades, ahead.

- Emotional discipline: Traditional markets are influenced by fear and greed. HODLers aim to overcome these emotions and make rational decisions based on research and a belief in technology.

- Reduce Risk: Constantly trading or “day trading” can be incredibly risky. HODLing means less exposure to short-term market swings.

- Tax Benefits: In some countries, keeping your crypto for more than a year can result in significant tax benefits.

The psychology of this strategy with an example

Imagine you bought Bitcoin (BTC) for $10,000. You watched the price skyrocket to $69,000 and thought about cashing out with a big profit. But then, in a matter of days, the price plummeted to $30,000. Panic seizes you. Should you sell to avoid further losses or HODL and wait for the market to recover?

This is where the psychology of HODLing comes into play. HODLers are often willing to put up with these wild price swings because they believe in the fundamental value of their chosen cryptocurrency. They understand that the cryptocurrency market operates 24/7 and that prices can change dramatically in a matter of hours.

In the example above, a HODLer would likely choose to hold onto his Bitcoin, confident in its long-term potential. They do not react to short-term price fluctuations; instead, they stick to their investment strategy and wait for the market to recover.

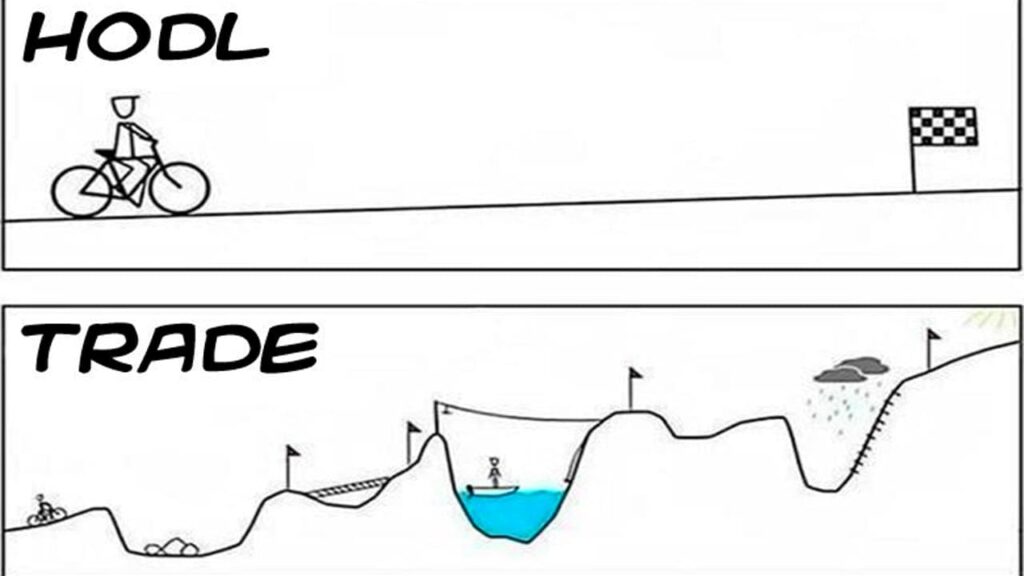

HODLing vs. Trading

They are often opposite concepts. Both strategies have their advantages, what is clear is that they cater to different mindsets.

– HODLing is for those who believe in the long-term potential of cryptocurrencies, are willing to endure market volatility, and are averse to the stress of frequent trading. It’s about buy and hold, come what may. It’s not for the faint of heart, it’s a strategy for those who blindly believe in the underlying technology and just sit and wait for the long haul.

– Trading, on the other hand, is for those who thrive on market dynamics, make decisions quickly, and enjoy taking advantage of short-term price fluctuations. Traders try to buy low and sell high, often placing multiple trades in a day.

It is important to note that both strategies can be profitable, but require very different approaches and risk – tolerance.

Famous HODL Stories

- Bitcoin Pizza: In 2010, a developer named Laszlo Hanyecz paid 10,000 Bitcoins for two pizzas. Those Bitcoins are now worth tens of millions of dollars. Laszlo should HODLed 🙂

- The Winklevoss Twins: You may know them from their time at the founding of Facebook, well, with the money they made, they were one of the first investors in Bitcoin, working their way up to becoming billionaires.

- The Bitcoin roller coaster: The volatility that cryptos have experienced has numerous ups and downs. Despite facing multiple dips and bubbles, Bitcoin has consistently rallied more strongly when halving cycles are taken into account.

- The Rise of Dogecoin: You may know it from the biggest crypto troll, Elon Musk. An alt-coin initially created as a joke to laugh at the traditional financial system, it experienced incredible price increases in 2021. Those who HODLed early on enjoyed the ride. In the following Bull Run the story was repeated with Shiba Inu. Today thousands of crypto gems pump the market with force.

- Future stories: At your fingertips, take a look at our section: How to find Low Cap Crypto Gems?

Best HODL Memes

To put a note of humor and to better understand the meaning it represents for crypto-believers, we have made a compilation of the best memes that roam the net. Enjoy!